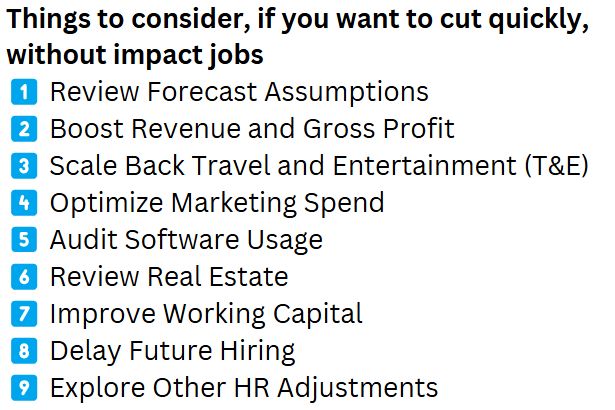

Controlling costs is a critical part of FP&A, both during budgeting and as actuals are reviewed each month. However, catalysts such as a revenue shortfall or an acquisition may require rapid cost-cutting measures.

In these cases, you need to maximize savings without compromising the company’s ability to execute its strategy and ideally without impacting anybody’s job. Below, I list some places to look if you need to cut costs quickly without resorting to layoffs.

Review conservative assumptions in the forecast

If the target is to preserve cash at the end of the year, start by reviewing the forecast to see if there are any hedges or sandbagging that can be removed. If actual results consistently outperform, there might be room to adjust the forecast. Although this is not true savings, this may reduce the need to eliminate costs.

Review ways to juice revenue and/or gross profit

Before cutting costs, explore opportunities to boost revenue or gross profit. Consider pricing adjustments, upselling or cross-selling strategies, and accelerating the launch of high-margin products or services. This should already be happening, but there may be some trends that are not fully captured in the forecast.

Manage discretionary spend more aggressively

Travel and Entertainment (T&E)

There is always potential to cut T&E. Although many people believe that there is a strong return on investment (ROI) to seeing customers in person and getting together as a team, this is often hard to prove. In addition, my observation is that T&E is typically not equal across teams, with some teams having multiple offsites and others having none.

Focus on large upcoming events scheduled in the next six months that are not yet finalized. Is there potential to scale the number of attendees? Move to a more cost-effective location? Cancel entirely?

Also, if the company’s travel policy is loosely defined and/or not well communicated, this could be an opportunity to solve two problems at once: (1) creating more guidance around T&E and (2) setting the company up to save in future periods.

Marketing

Marketing spend is often a prime savings target due to its discretionary nature and significant size at many companies.

If the marketing team has clear ROI data by channel, there may be good reason to not reduce marketing spend, particularly if the payback period is shorter.

However, ROI by channel is often vague or poorly defined, which can put you in a tricky situation. You don’t want short-term savings to impact future results but keeping the spend without knowing the impact is not sustainable or wise either. If you have a good relationship with a finance-savvy head of marketing, this person can help point you in the right direction for potential savings, even if it’s based on intuition.

Whatever you decide to do in the near term, improving marketing analytics should be on your list in the coming budget cycle.

Audit software spend and opportunistically look at other ‘fixed’ run-rate spend

At some companies, software licenses are provided to anybody who asks, with no follow-up to check if they’re being used. This can lead to wasted spending on unused tools. Near-term savings often depend on contract structures, and SaaS management tools can help consolidate contract details and user counts in one place. If your company lacks such a tool, ask the head of IT—they may already know where quick savings can be found. As with marketing though, you may decide that this is better addressed during the next budgeting season.

Renegotiating with vendors can also unlock quick savings, especially if your contracts are up for renewal soon. Focus on high-cost agreements where there’s room to adjust terms or rates.

While remote work has made this less common, it’s still worth evaluating office and real estate. Unused properties could be sold or sublet.

Review working capital management practices

Optimizing working capital can be a fast way to free up cash. Review payment terms with suppliers and tighten up your collections process to ensure customers pay on time, or even early with discounts. This should already be happening and won’t impact the income statement but could be a way to boost cash flow in the near term if preserving cash is the issue.

Delay future To Be Hired (TBH) roles and other HR-related costs

Slowing the growth of headcount is the last ‘easy’ option. To be clear, cost center owners strongly dislike when you take away heads that have already been approved. However, it’s generally much easier to do than reducing existing headcount.

If TBHs were thoroughly vetted during budgeting, removing them may strain existing employees, effectively requiring them to work harder, be more efficient, and “do more with less.” While this may drive forced efficiency, it can also negatively impact employee satisfaction and engagement.

Other, likely unpopular, options include pay cuts and salary freezes. However, these may be preferred to job cuts.

If you need to go further This is the first in a series of posts on cost-cutting strategies. Next, I’ll explore how to think about different functional areas: G&A, R&D, and S&M.

Leave a comment